Economists seek further 200 bps cut in policy rate

Web Desk

|

24 Oct 2024

The economists hope for the fourth consecutive cut in the policy rate by 200 in the upcoming meeting of the monetary policy committee, set to be held in November.

The consecutive cuts in monetary policy are the result of declining inflation, a low current account deficit, and high remittances.

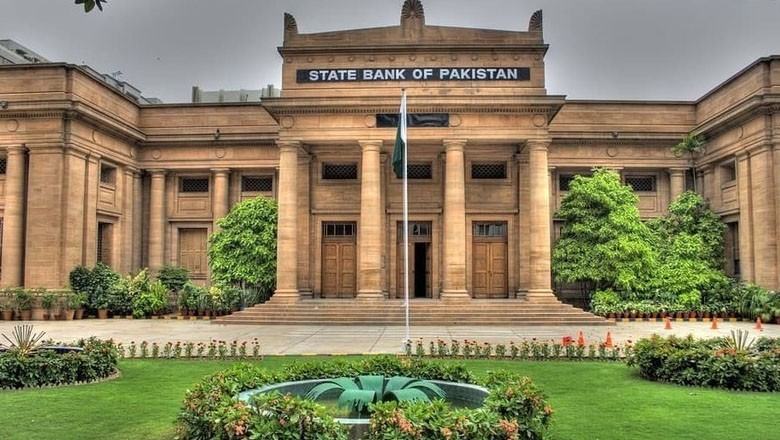

Previously, the State Bank of Pakistan (SBP) had made three cuts since June, which had declined by 450 basis points cumulatively, bringing it down to 17.5 percent from an unprecedented high of 22 percent.

However, the major cut did not show a strong sign of recovery in the economy, with negative growth in the large manufacturing sector (LSM) during the two months of FY25.

Experts attributed the decline in the policy rate to the downward inflation rate, however, the trade and industry sector demanded a sustainable cut in the interest rate to around 10 percent, slightly above than inflation rate.

“The declining inflation, which has gone down to a 44-month low in September and is expected to dip more in October, is a main key behind the cut,” said Tahir Abbas, head of research at Arif Habib Ltd.

Mr Abbas expects a further cut in the policy rate by 200 points to 15.5 percent in the upcoming monetary policy rate, following the meeting of SBP’s MPC, set to be held on November 4.

In November FY22, the policy rate stood at 16 percent.

The Topline security also expected a 200bps rate which would bring the total reduction to 650bps.

Comments

0 comment